|

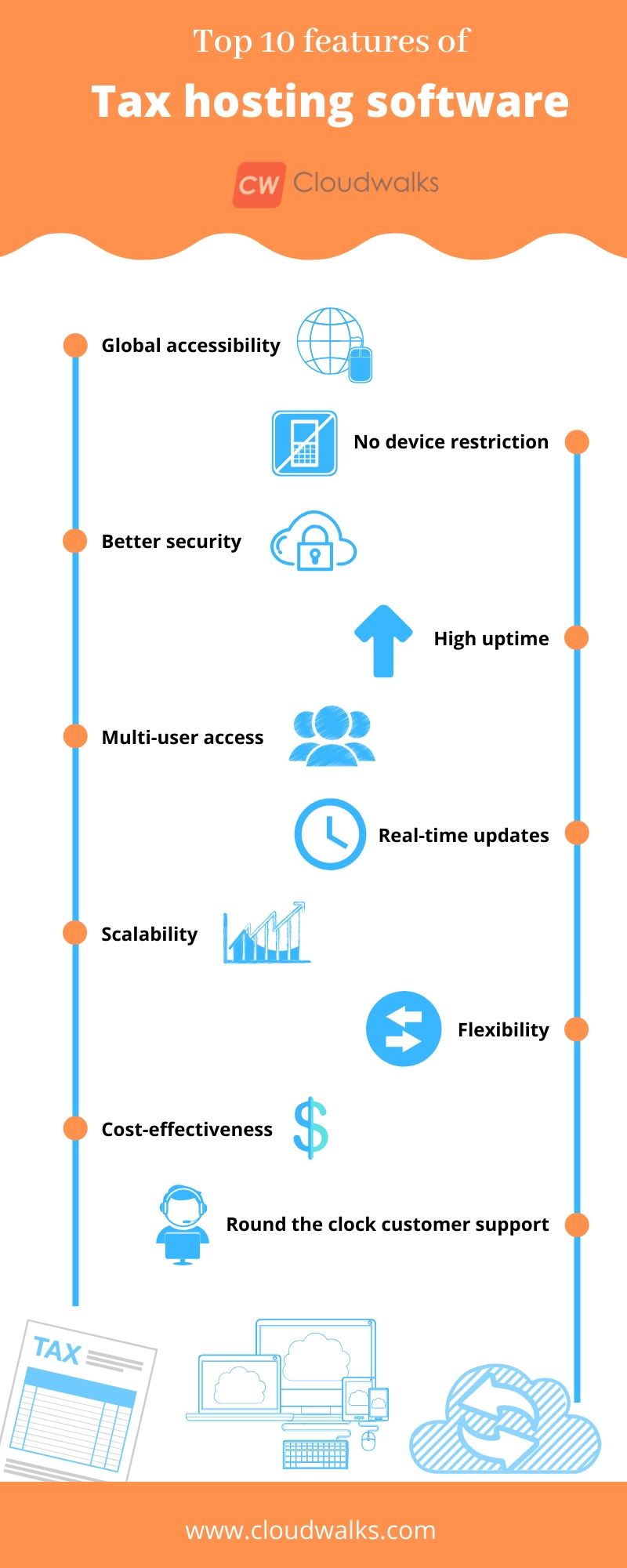

Tax software has become an essential part of each and every type of business. With the help of tax hosting software, users can easily automate most of their tax-related task and this will not only boost the speed of tax filing but it will also enhance the accuracy of both tax management and tax filing. Most of the users have abandoned their old age calculator and printed tax forms as the world has moved towards digitization and the same has been adopted in the world of tax. But you should know that just using the tax software by installing it on your desktop isn’t enough as the current need of the market s hosted tax software. In the hosted solution, you use the same desktop tax software on the cloud and there are many benefits of using the hosted version of the tax software. You should know that if you will be using the hosted tax software then you will be able to make tax filing and tax management a pie. You will just need to choose the best tax software hosting provider and then you will be able to host your tax software on the cloud server of the cloud vendor without any hassle. So, let’s go through the top 10 features of tax hosting software and understand why it has become the new normal for each and every type of business. 1. Global accessibilityOne of the major features of using tax hosting software is global accessibility. If you will be using the tax hosted software then you will be able to access the data and the software from every corner of the world. You can easily use the provided RDP, log into your tax software and start working on your tax without worrying about your location and the time when you are using the software. 2. No device restrictionAnother most talked about feature of hosted tax software is there is no device restriction. You can use any device that has internet access in order to use your tax software. While working on the cloud model, there is no restriction on the device and you don’t need to install the software on that particular device in order to use it. From simple smartphones to tablets, you can literally use any device that has an internet connection. 3. Better securityYou will never wish to compromise with the security of your tax data and this is what tax hosted software offers to you. Cloud is surely the safest place for storing your data related to taxes and you will never have to worry about data breaches or any other type of cyberattack. Even the most expert criminals find it very difficult to steal the data stored on the cloud. So, heightened security is another feature of cloud-hosted tax software. 4. High uptimeIf you will choose a good and reputed cloud vendor in the market then you will be able to get 99.99% of high uptime and this uptime is guaranteed from the cloud vendor. You should know that such a high uptime means only a couple of minutes of downtime in a whole year. So, if you will work on hosted tax software then you will face minimal interruption and you will never be locked out of your system. 5. Multi-user accessCollaboration becomes a pie with the hosted version of the tax software. Even with multiple employees sitting at different locations, using different devices, you can easily collaborate with the whole team as the multi-user feature allows you to easily collaborate with people sitting at distant locations at the same time. 6. Real-time updatesIf you will be working on the cloud model then you will never have to send data back and forth in between your teammates. You will always get real-time updates for the changes made by the other user and this allows you to work like a team, without even sitting under a single roof. 7. ScalabilityThe cloud platform is highly scalable and that’s why tax hosted software is highly suggested for small and medium-sized businesses because SMEs have maximum chances of growth. With the tax hosted software, you can easily scale up your cloud needs as per the growth of your company and you can even scale down if you are facing a downfall or reduction in demand in the market. 8. FlexibilityThe flexibility provided by the tax hosted software can’t be matched by anything else. If you have chosen a tax hosting provider and if you are not satisfied with the cloud services provided by the cloud vendor then you can easily switch the vendor as there is no involvement of contract in cloud hosting. You don’t need to stick with a poor performing cloud vendor if it is not up to the mark. 9. Cost-effectivenessCloud-hosted tax software is surely the cheapest way of using the cloud platform without compromising on the security and benefits of cloud. You will never have to spend money on building an IT infrastructure or hiring IT employees. You will just need to pay the nominal fee of the cloud vendor and you will have to follow the pay-as-you-go model which is much cheaper and cost-effective. 10. Round the clock customer supportIf you are facing any type of issue in the cloud-hosted tax software then you will never have to deal with on your own. The cloud vendor will offer you round the clock customer and you don’t have to pay even a single dime for this service.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Most useful blogs |

Hosted Applications |

Tax Hosting Services |

Accounting Applications |

ContactAddress

Cloudwalks Hosting, Inc. 40 Exchange Place, Suite 1602 New York, NY 10005 |

RSS Feed

RSS Feed