|

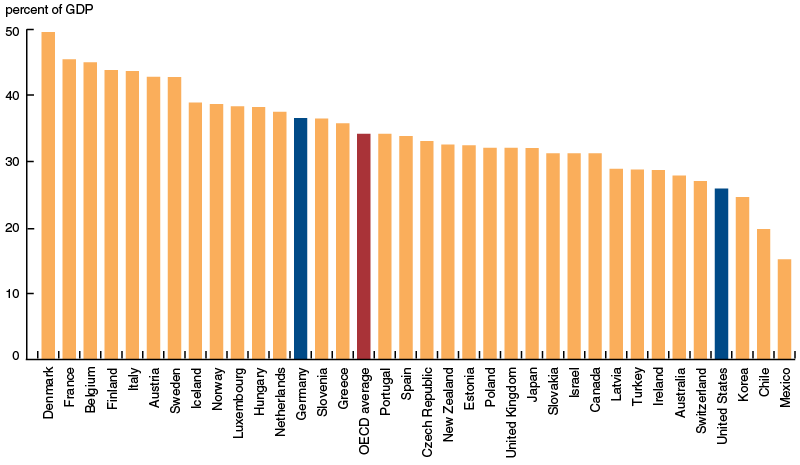

Here’s the question – how much taxes do Americans really pay compared to people from other countries? As providers of cloud hosted application such as ProSeries, ATX, Drake, Lacerte and QuickBooks hosting to individuals, professionals and small and midsize business owners in the US and the rest of the world, we are in a unique position to answer this question. The IRS data for the 2015 tax year shows that Americans paid out a total of $1.454 trillion in income tax. This means an average federal tax rate of 13.5% per return. But that doesn’t tell the whole story as there are a number of other taxes Americans pay, such as the State and Local income taxes, Social Security Tax, Medicare Tax and Property Tax. All of these are in addition to the Sales Tax. So an average American taxpayer aid $9,655 in federal income tax and had a gross income of $71,258. But this is not really an accurate measure as it doesn’t take into consideration that over 50 million tax returns filed last year had absolutely no tax liability. Just 99.2 million tax returns owed income tax, following adjustments, exemptions, deductions and tax credits. So an average taxpayer who paid income tax found himself or herself with a tax bill of $14,654. So how does this compare with the rest of the world? The U.S. government wants to reduce taxes greatly, which they believe to be among the highest rates in the world. To be fair, if one was to make an assessment of how much taxes Americans paid and compared that with the rest of the world, it’s not as bad as you think it is.  Note: Including social security contributions. Source: Organisation for Economic Co-operation and Development (OECD). Note: Including social security contributions. Source: Organisation for Economic Co-operation and Development (OECD). The Federal Reserve of Chicago published a research paper which includes the above chart. This chart has all the details on the tax burdens faced by citizens of the 35 OECD countries as on 2014. The United States has a tax burden of 25%, according to this chart, which is a measure which includes factors such as income, property and a number of other taxes. This is well below the tax burden faced by citizens of other countries such as Mexico, Chile and South Korea. What the US does have is a very high nominal maximum rate when it comes to taxing corporate profits. However, it can be seen that Germany has a much lower tax on corporate profits. Germany is looked at with awe by the current administration in the US because it enjoys a trade surplus vis-à-vis the United States. This gives them an upper hand through all trade negotiations. Now, while US companies pay a higher income tax than German companies, that is only when you consider the nominal tax rate. Because of deductions, and various tax strategies, US companies actually end up paying a lot less in tax, not more than 20% on an average. Even then, it does not compare with Germany, which has an effective tax rate on corporate profits of just 15%. So the takeaway from this is that while income tax rates in the US are not as high as you are led to believe, the corporate tax rate is high and can be made more competitive.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Most useful blogs |

Hosted Applications |

Tax Hosting Services |

Accounting Applications |

ContactAddress

Cloudwalks Hosting, Inc. 40 Exchange Place, Suite 1602 New York, NY 10005 |

RSS Feed

RSS Feed