|

QuickBooks dispels many accounting barriers while streamlining your businesses. It is the most famous accounting software which is used by millions of accountants, CPAs and small business. There is no magic behind the popularity and huge user base of this accounting software as the developers at Intuit have worked very hard to satisfy the evolving and diverse accounting needs of various industries and business size. Among the various accounting tools available in QB, the direct deposit function is another great feature which makes your payment process a lot easier. You just have to choose your employee (with their working hour, vacation leaves and other details), schedule the deposit and choose a U.S bank account, that’s it. With such a simple process, you will be easily able to make payment without getting stuck to the intricate payment processes.

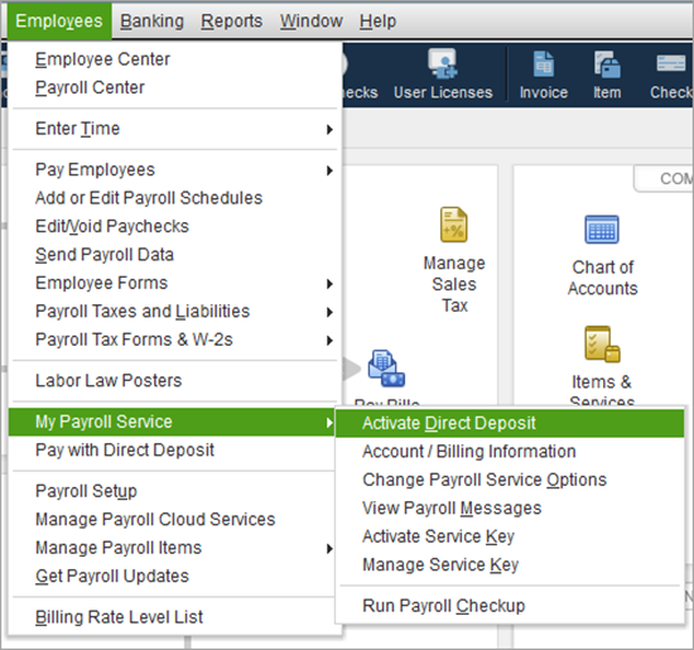

So let’s learn some of the basics of the direct deposit for employees in QuickBooks desktop so that you can use it in the best possible way. How employees can receive this direct deposit? All the employees who wish to receive direct deposit need to fill out a Direct Deposit Authorization form and then hand over a voided check from their bank account. But you don’t need to submit the voided check or the authorization form to QuickBooks as they are for your records only. How to set up an employee for the direct deposit?

After setting up a the direct deposit for employees, all the paychecks created for them will get automatically marked for the direct deposit, but in case you have already created a paycheck and want it to use in the direct deposit then you will have to delete the current paycheck and then recreate it. How to edit the information of an employee’s direct deposit details? You can easily update the bank account information of an employee’s direct deposit by using the same page where you entered the details. But you have to keep this thing in mind that you will have to update the bank account of the employee before clicking on the send button of the paycheck, otherwise the paycheck will be sent to the previous bank account of the employee. And if you have made the mistake, then you will need to delete and then remake the paycheck before sending it to Intuit. Or, you can follow the below-mentioned steps:-

How to remove direct deposit for an employee forever?

Important things to remember before setting up the direct deposit of an employee

Setting up and using the direct deposit feature of the QuickBooks desktop is very and it helps in saving you a lot of time, while minimizing the hassle of payments. You can also save a big amount by choosing the direct deposit feature as by choosing it, you will be able to $176 per employee per year. You have to pay just $1.75 on each paycheck and all the functions and benefits of this great tool will be yours.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Most useful blogs |

Hosted Applications |

Tax Hosting Services |

Accounting Applications |

ContactAddress

Cloudwalks Hosting, Inc. 40 Exchange Place, Suite 1602 New York, NY 10005 |

RSS Feed

RSS Feed